Is now the time to consider an Enterprise Management Incentive (EMI) Scheme?

As inflation in the UK hits a 40-year high, business costs are soaring. Many employers are dealing with staff attraction and retention issues as employees are looking for employment tax solutions to offset the cost-of-living crisis where possible.

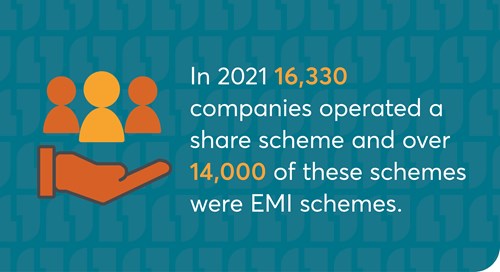

With businesses still recovering from the impact of COVID-19, cash resources are tight. Therefore, the implementation of non-cash benefits such as share schemes, including the Enterprise Management Incentive Scheme, can be a great short-term investment to retain and motivate key staff.

Long-term benefits

Share schemes also have longer-term benefits. Their flexibility means they are a great way to align employees’ incentives with the goals of the business, be they turnover targets or perhaps a potential sale in the future.

This is achieved by awarding the employees options over shares, with the conditions to exercise these options and become a shareholder in the business being aligned to the goals of the business.

Assuming the exercise price (i.e., the price to convert the option to a share) of the options is no less than the market value at the date of the grant, there should be no income tax or National Insurance contributions (NIC) to pay at any point during the life of the option. This leaves just capital gains tax (CGT) payable on any eventual disposal of the shares acquired under the options.

Given that CGT rates are currently lower than income tax rates, this can be extremely attractive compared to paying income tax and NIC.

However, as with all HMRC tax advantaged schemes, there are specific qualifying conditions and both the employee and the company must qualify for EMI to be available.

Qualifying conditions

As a brief overview only, normally only the largest of companies (or those in complex group structures) are excluded from EMI and therefore it is certainly a share scheme to consider for most SMEs.

To qualify for the generous tax advantages afforded by EMI, the gross assets of the company (or the group of companies if a parent company) must not exceed £30 million, and the options held by an employee must not exceed £250,000 in value.

The company must also have fewer than 250 full-time employees (or equivalent), the participants in the scheme must generally work for the company at least 25 hours a week (or 75% of their working time if part time) and they must not already have a material interest in the company.

Companies trading in certain sectors are unable to grant EMI qualifying options. Excluded activities include leasing, financial activities and property development.

How we can help

Making sure that a company qualifies for the tax reliefs afforded by EMI is an important part of the planning stage and something we are able to help with. However, if EMI is not available, there are other tax advantaged share schemes available, such as the Company Share Ownership Plan (CSOP), or with appropriate legal and tax advice, non HMRC approved schemes can be designed in a tax efficient manner.

Please contact your usual Larking Gowen contact if this is something you would like to discuss further. You can find contact details in the Our People section of our website. Alternatively, call 0330 024 0888 or email enquiry@larking-gowen.co.uk.

Tessa Brown

Newsletter

Sign up to receive the latest news from Larking Gowen

About the author

Larking Gowen