Stamp Duty Land Tax: Last chance to claim Multiple Dwellings Relief

Stamp Duty Land Tax: Last chance to claim Multiple Dwellings Relief

In the spring Budget 2024, the Government announced that it will abolish Multiple Dwellings Relief (MDR), a tax relief from Stamp Duty Land Tax (SDLT) that applies to bulk purchases of properties, for transactions with an effective date on or after 1 June 2024. Transitional rules mean that MDR can still be claimed for contracts exchanged on or before 6 March 2024, regardless of when completion takes place. This is subject to various exclusions, for example, if there’s a variation in the contract after that date.

What is Multiple Dwellings Relief (MDR)?

MDR applies when purchasing more than one dwelling in a transaction or a number of linked transactions. Instead of calculating the SDLT payable on the whole transaction(s), divide the total amount paid for the properties by the number of dwellings, work out the SDLT payable on the divided figure, and multiple this by the number of dwellings. There’s a minimum rate of tax under the relief of 1% of the amount paid for the dwellings.

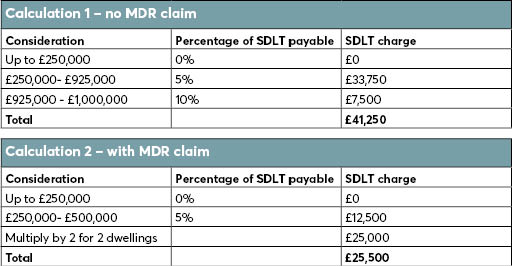

Therefore, the SDLT will be reduced by increasing the amount chargeable at the lower rate bands of SDLT. For example, if a property was purchased for £1,000,000, which was deemed to be two dwellings, and MDR was claimed, the SDLT payable would be £25,000, rather than £41,250 if no MDR was claimed; so a saving of £16,250.

MDR is really aimed at the situation when a buyer may be purchasing a block of, say, 10 flats which, under the old slab system, would have incurred SDLT at the 10% rate on the whole transaction, rather than the 2% rate if the 10 flats had been bought by different buyers. It was therefore originally introduced to reduce unfairness.

However, in recent years, it has been commonly used when individuals are buying two separate dwellings, for example, a house with a granny annexe.

What is a separate dwelling?

What is a dwelling is ultimately a subjective question and therefore HMRC could potentially challenge self-assessments made on SDLT returns.

For a dwelling to be treated as separate it must be capable of independent, long-term occupation. HMRC will consider a number of different factors and take an overall balanced view.

Please be aware that there are companies out there that encourage MDR claims when the word ‘annexe’ appears in a property’s sales particulars. Many of these claims are tenuous and, when the facts are considered in detail, they don’t meet the tests for being a separate dwelling. This has led to HMRC winning court cases where MDR was claimed aggressively.

Things to watch out for:

Higher Rate for Additional Dwellings (HRAD)

The basic rates of SDLT are increased by 3% where an individual purchases an additional dwelling. Therefore, it would be logical to believe that, when MDR is being claimed, the 3% HRAD rate will apply. However, this isn’t always the case and special rules for ‘subsidiary dwellings’ need to be considered.

Clawbacks

The SDLT saved by claiming MDR can, in some cases, be clawed back. If the number of dwellings is reduced within three years of the transaction, then the relief will be withdrawn. So, for instances with granny annexes, if they’re converted into a garage or a home office within three years then additional SDLT will become payable.

Need help?

If you have any queries, or would like to discuss this further, please get in touch with your usual larking Gowen contact. You can find contact details on the Our People section of the website or email enquiry@larking-gowen.co.uk.

Alex Coghill and Vicky Craske

Newsletter

Sign up to receive the latest news from Larking Gowen

About the author

Larking Gowen