Company size limits and FRS 102 changes – what you need to know

Changes in FRS 102 accounting rules have been confirmed by the Financial Reporting Council (FRC). Although the mandatory effective date is 1 January 2026, we advise that entities begin to consider how their revenue recognition and lease accounting policies may change and how this might affect their business.

For many entities, the changes to lease accounting will impact the calculation of gross assets and earnings before interest, depreciation, taxes and amortisation (EBITDA). In turn, borrowing covenant compliance may be affected and increased balance sheets assets will push some companies above company size, and therefore audit, thresholds.

The UK Government has also announced its intention to raise company size thresholds which, among other impacts, would make some companies audit exempt.

What are the changes?

The announcements were just days apart: the company size proposal was announced on 19 March 2024, and the FRS 102 amendments were published on 27 March 2024.

FRS 102 changes

The main amendments to FRS 102 relate to revenue recognition and lease accounting, aimed to provide greater consistency and alignment to international accounting standards.

The amendments introduce a five-step recognition model for revenue from contracts with customers, based on the international accounting standards model:

- Timing of income recognition may be affected.

- Entities will have to identify the distinct goods and services provided to a customer and how much consideration the entity will receive in relation to each of these.

- Entities will, in particular, need to consider the treatment for contracts that have bundles of goods/services, variable consideration, warranties, customer options, or significant financing components.

The distinction between operating and finance leases is removed, meaning almost all lessees will need to include leases on the balance sheet.

- Operating lease accounting will be replaced by a right-of-use asset and a lease liability on the balance sheet – i.e. a treatment similar to current finance lease accounting.

- There will be exemptions for short-term and low value leases, meaning that these don’t need to be recognised on the balance sheet.

- Compared to international accounting standards, FRS 102 will have a higher threshold for low value assets, meaning FRS 102 preparers won’t have to recognise as many leases on the balance sheet.

There are a significant number of other changes, including more clarity on disclosures for small entities.

Company size changes

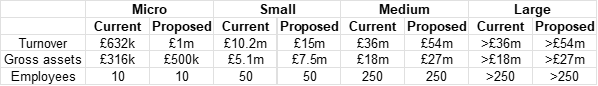

The Government has proposed that the monetary thresholds used to determine company size would increase by 50%, with the threshold for the number of employees remaining unchanged. These new limits would continue to be tested on a two out of three basis. The current and proposed company size thresholds are detailed below:

This would affect which companies fall within the scope of statutory audit as well as various financial and non-financial reporting requirements.

When will the changes apply?

The effective date for the majority of FRS 102 amendments is accounting periods beginning on or after 1 January 2026, meaning that, except for short periods, December 2026 year ends will be the first affected. Early adoption is permitted, and transitional arrangements will be provided.

The Government intends that companies will be able to benefit from the changes in the company size thresholds for periods starting on or after 1 October 2024, however, the proposal and the effective date are yet to be confirmed.

Why does this matter and what should I do?

As stated above, the FRS 102 changes may affect your company profit, earnings and net debt. Debt covenants may be affected. Balance sheet and threshold changes may affect company size, company reporting and audit requirement.

If you’d like to discuss any of this further, please get in touch with your usual contact. You can find contact details on the Our People section of the Larking Gowen website. Alternatively, call 0330 024 0888 or email enquiry@larking-gowen.co.uk.

James Nichols

Newsletter

Sign up to receive the latest news from Larking Gowen

About the author

Larking Gowen